Moving Company Shares Data on Cincinnati's Growing Moving Trends

CINCINNATI, OH, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- Moving Ahead Services has released comprehensive 2025 migration data for the Cincinnati metropolitan area, revealing dynamic residential patterns and significant insights into the region's economic transformation. The analysis, drawn from thousands of moves completed throughout 2025, highlights both local neighborhood shifts and long-distance migration trends that are reshaping the Queen City's demographic landscape.

2025 Overview: A Tale of Two Markets

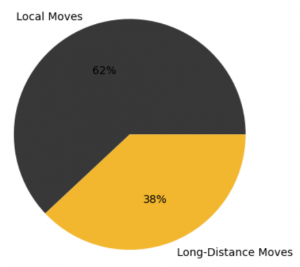

The data reveals a striking division between local and long-distance moving activity in Cincinnati. Approximately 62% of Moving Ahead Services' Cincinnati operations in 2025 involved local moves within the tri-state area, while 38% represented long-distance relocations—a notable increase from the typical 30% long-distance activity seen in previous years.

"Cincinnati is experiencing simultaneous growth in both local neighborhood transitions and cross-country relocations," said a representative from Moving Ahead Services. "This dual dynamic suggests a maturing housing market where existing residents are optimizing their living situations while the region attracts significant numbers of newcomers from other states."

Local Moving Trends: Neighborhood Evolution

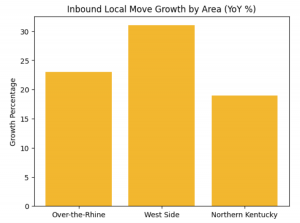

Within the Cincinnati metropolitan area, 2025 data shows clear patterns of urban revitalization and suburban repositioning. Over-the-Rhine (OTR) continued its transformation, experiencing a 23% increase in inbound local moves compared to 2024, primarily attracting residents from older suburban areas and other urban neighborhoods seeking the district's walkability and cultural amenities.

The West Side neighborhoods—particularly Westwood, Price Hill, and Lower Price Hill—emerged as significant growth areas in 2025, with inbound moves increasing 31% year-over-year. This surge appears driven by affordability considerations, with many movers relocating from more expensive urban cores while maintaining proximity to downtown employment centers.

East Side suburbs including Hyde Park, Oakley, and Mount Lookout maintained steady activity, though the data reveals an interesting shift: rather than traditional family relocations, these neighborhoods increasingly attracted established professionals and empty nesters downsizing from larger suburban homes in areas like Mason, West Chester, and Blue Ash.

Northern Kentucky communities—particularly Covington, Newport, and Bellevue—saw a 19% increase in inbound moves from Ohio residents, driven largely by housing affordability and urban amenities. The convenience of downtown Cincinnati access combined with lower property costs made Northern Kentucky an attractive option for young professionals and first-time homebuyers.

Traditional suburban strongholds like Mason, West Chester Township, and Liberty Township experienced net outbound movement in 2025, though total moving activity remained high. The data suggests these areas are experiencing demographic turnover rather than decline, with empty nesters moving out as new families with school-age children move in.

Long-Distance Migration: National Attraction

The long-distance moving segment tells a compelling story about Cincinnati's growing national appeal. In 2025, Moving Ahead Services handled a 28% increase in long-distance inbound moves to Cincinnati compared to 2024, significantly outpacing outbound long-distance relocations.

Inbound Long-Distance Moves:

The top origin states for people moving to Cincinnati in 2025 were:

- California (18% of inbound long-distance moves) – Driven primarily by tech workers and remote professionals seeking lower cost of living. The average California-to-Cincinnati mover cited housing costs as the primary factor, with many purchasing homes in the $300,000-$450,000 range that would cost $800,000+ in their previous markets.

- Illinois (15%) – Chicago residents represented the bulk of Illinois moves, with many citing job opportunities in Cincinnati's growing corporate sector (Procter & Gamble, Kroger, and emerging tech companies) combined with more affordable family housing options.

- New York (12%) – Split between New York City professionals embracing remote work and upstate New York residents relocating for healthcare and manufacturing jobs in the Cincinnati region.

- Florida (11%) – Interestingly, Florida appeared as both a major origin and destination state. Inbound Florida movers tended to be retirees returning closer to family or young professionals priced out of Florida's inflated housing market.

- Texas (9%) – Primarily Houston and Dallas residents relocating for corporate transfers or seeking a different lifestyle with more distinct seasons and established urban infrastructure.

Outbound Long-Distance Moves:

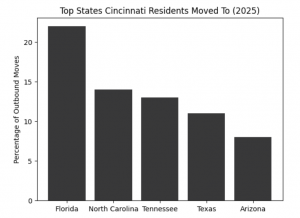

Cincinnati residents moving out of state in 2025 primarily relocated to:

- Florida (22% of outbound moves) – Retirees seeking warmer climates dominated this category, with Tampa, Jacksonville, and the Gulf Coast as primary destinations.

- North Carolina (14%) – Charlotte and Raleigh-Durham attracted young professionals and families, often for job opportunities in tech and finance sectors.

- Tennessee (13%) – Nashville's booming economy and growing cultural scene made it the primary Tennessee destination for Cincinnati transplants.

- Texas (11%) – Austin and Dallas attracted younger professionals, often in tech fields, seeking career advancement and different lifestyle options.

- Arizona (8%) – Phoenix area moves were almost exclusively retirees seeking warm, dry climates.

Despite outbound activity, the data shows Cincinnati maintained a positive net migration balance of approximately +15% for long-distance moves in 2025, indicating more people moving to the region than leaving it.

Economic and Demographic Implications

The migration patterns reveal significant insights about Cincinnati's economic trajectory. The influx of residents from high-cost coastal markets brings increased purchasing power, with the average inbound long-distance mover having a household income 32% higher than the regional median. This demographic shift supports the continued development of upscale dining, retail, and entertainment options throughout the urban core.

Local moving patterns suggest a maturing urban housing market. The 2025 data shows that 41% of urban neighborhood moves involved households upgrading to larger spaces within the same neighborhood—a sign of economic confidence and community attachment rather than displacement.

"What's particularly encouraging is that people aren't just moving to Cincinnati—they're staying and moving up within their chosen neighborhoods," noted Moving Ahead Services. "This indicates strong community ties and satisfaction with urban living options."

The suburban-to-urban migration trend continued in 2025, though at a more moderate pace than previous years. Approximately 27% of urban inbound moves originated from suburban locations, suggesting that while urban living remains attractive, the most enthusiastic early adopters have already made their moves.

Housing Market Insights

Moving data correlates closely with housing market activity. Neighborhoods with the highest inbound moving activity—OTR, Westwood, Oakley, and Northern Kentucky communities—also experienced the strongest home price appreciation in 2025, with year-over-year increases ranging from 8% to 14%.

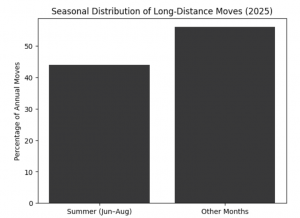

The company's data also reveals seasonal patterns consistent with housing market cycles. Long-distance moves peaked during summer months (June-August), accounting for 44% of annual long-distance activity, while local moves distributed more evenly throughout the year with a slight spring surge.

Interestingly, the average time between moves has increased. Cincinnati residents who moved locally in 2025 had resided in their previous homes for an average of 6.8 years, up from 5.9 years in 2020. This suggests increased housing stability and satisfaction, or potentially challenges with housing affordability limiting mobility.

Remote Work's Continuing Impact

Remote work arrangements continue shaping migration patterns. Moving Ahead Services' data shows that approximately 34% of long-distance inbound movers identified remote work flexibility as a primary factor enabling their relocation to Cincinnati. This represents a slight decrease from 2023's peak of 42%, but remains significantly higher than pre-pandemic levels.

The remote work factor particularly impacts neighborhood choice. Remote workers moving to Cincinnati showed strong preferences for walkable urban neighborhoods (43%) or close-in suburbs with urban amenities (38%), rather than traditional car-dependent suburban developments (19%). This preference pattern differs markedly from traditional relocators, who split more evenly across urban, suburban, and exurban options.

Looking Ahead to 2026

Based on early indicators and current trends, Moving Ahead Services projects continued momentum in Cincinnati's migration patterns heading into 2026, with several key expectations:

- Long-Distance Migration: The company anticipates continued positive net migration from coastal markets, though potentially at a slightly slower pace as remote work policies stabilize. The expected 5-10% increase in long-distance inbound moves will likely be driven by corporate relocations, healthcare sector growth (Cincinnati's expanding biotech and medical device industries), and continued cost-of-living arbitrage from high-cost markets.

- Urban Neighborhood Expansion: The urban revival is expected to extend beyond established neighborhoods. Areas like Walnut Hills, Evanston, and Northside—which showed emerging activity in late 2025—are positioned for accelerated growth in 2026. Moving Ahead Services projects a 20-25% increase in moves to these transitional neighborhoods as earlier-stage homebuyers and investors recognize opportunity.

- Suburban Differentiation: Not all suburbs will experience identical trends. First-ring suburbs with urban connectivity (Norwood, St. Bernard) and walkable town centers are expected to outperform car-dependent developments. Exurban areas beyond the I-275 loop may see modest declines in attractiveness for younger demographics, though they'll remain strong for traditional families seeking larger properties and specific school districts.

- Northern Kentucky Acceleration: The company expects Northern Kentucky's momentum to accelerate in 2026, potentially seeing 25-30% growth in inbound moves from Ohio. Continued development of Covington and Newport's urban infrastructure, combined with persistent housing cost advantages, positions NKY as a major growth area.

- Corporate Relocations: Cincinnati's success in attracting corporate headquarters and expansions (recent announcements in life sciences and technology sectors) suggests increased corporate relocation activity in 2026, which typically drives 15-20% of long-distance moves in the region.

- Demographic Shifts: The data suggests Cincinnati will continue attracting a younger, more diverse population through long-distance migration while experiencing age-related outmigration of retirees. This generational turnover will likely accelerate neighborhood change and support continued investment in urban amenities, entertainment options, and cultural institutions.

Regional Competition

Cincinnati's migration performance in 2025 positioned it favorably against regional competitors. While Columbus continued to lead Ohio in absolute population growth, Cincinnati's net positive long-distance migration and higher-income inbound movers suggest quality-of-growth advantages.

Compared to similar Midwest metros like Indianapolis, Louisville, and Pittsburgh, Cincinnati maintained competitive positioning through its combination of corporate opportunities, urban renaissance, and relative affordability. However, Nashville and Charlotte continue to outpace Cincinnati in attracting young professionals, suggesting opportunity for continued improvement in marketing the region's assets.

Methodology and Data Transparency

Moving Ahead Services' analysis draws from comprehensive operational data including move origin and destination addresses, timing, household size indicators, and service selections. While individual customer information remains confidential, aggregate patterns provide valuable insights into regional migration dynamics.

The company acknowledges limitations in the data—it represents moving company customers rather than all relocations and may skew toward middle-to-upper income households more likely to use professional moving services. However, the scale of operations (thousands of annual moves) and consistent methodology enable meaningful year-over-year trend analysis.

Community Impact

Understanding migration patterns helps multiple stakeholders. Municipal planners can anticipate infrastructure needs, school districts can project enrollment changes, businesses can make location decisions, and residents can make informed choices about where to live and invest.

"We're not just moving furniture—we're part of the fabric of how Cincinnati evolves," said Moving Ahead Services. "By sharing this data, we hope to contribute to informed decision-making that benefits everyone in the region."

The company plans to continue releasing annual migration reports, potentially expanding data collection to include additional demographic indicators and migration motivations. This commitment to transparency reflects Moving Ahead Services' broader mission of community engagement beyond traditional moving services.

About Moving Ahead Services

Moving Ahead Services is a professional moving company serving Cincinnati and the tri-state area, providing residential and commercial moving solutions throughout Ohio, Kentucky, and Indiana. With a commitment to reliable service and community engagement, the company combines operational excellence with local market expertise. For more information, visit https://movingaheadservices.com/locations/cincinnati/

Jeff Collins

Moving Ahead Services

+1 (440) 256-2224

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.