UK Acidity Regulators Market Gains Momentum USD 2,075.1 Million as Beverage and Packaged Food Output Expands

UK demand for acidity regulators is rising as food and beverage brands prioritise pH control, flavour consistency, and shelf-life reliability.

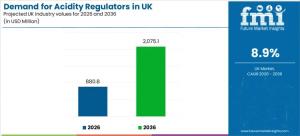

NEWARK, DE, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- Demand for acidity regulators in the UK is entering a sustained growth phase as food and beverage manufacturers place tighter control on pH management, flavour repeatability, and shelf-life assurance. The market is projected to expand from USD 880.8 million in 2026 to USD 2,075.1 million by 2036, advancing at a CAGR of 8.9%. This trajectory reflects how acidity regulators have shifted from optional formulation tools to core operational ingredients in high-throughput production environments.

Acidity regulators operate at the intersection of formulation science and manufacturing reliability. They enable producers to stabilise taste profiles, reduce batch-to-batch variation, and maintain microbiological safety where thermal processing or cold-chain controls alone are insufficient. As SKU complexity rises and reformulation cycles accelerate, dependable pH control has become a strategic requirement rather than a technical detail.

These ingredients include food acids and their salts used for acidification, buffering, and pH adjustment. In everyday production, they support beverages, sauces, processed meals, bakery products, and confectionery. Beyond acidity control, they influence texture stability, colour retention, and ingredient functionality in protein-rich, fat-based, and emulsified systems. Consistent pH management allows brands to maintain sensory integrity despite seasonal raw material shifts or supplier changes.

From a leadership perspective, market expansion is closely tied to brand protection and operational predictability. Retailer specifications are tightening, private label competition is intensifying, and product failures carry immediate commercial risk. Ingredient suppliers that deliver consistent purity, documentation strength, and responsive technical support are increasingly viewed as long-term partners rather than commodity vendors.

Quick Stats: UK Acidity Regulators Market

• Market value (2026): USD 880.8 million

• Forecast value (2036): USD 2,075.1 million

• CAGR (2026–2036): 8.9%

• Fastest-growing region: England

• Leading type: Acetic acid

• Largest application: Beverages

Why the UK Is Building Structural Demand

UK demand is driven by functional dependency. Beverage manufacturers balancing sweetness, fruit intensity, and carbonation treat pH control as a primary quality lever. Packaged food producers rely on acidity regulators to standardise taste and manage spoilage risk across national distribution networks.

Regulatory clarity further supports adoption. The Food Standards Agency provides well-defined guidance on approved additives and E numbers, giving formulation teams confidence that ingredient choices remain compliant across product portfolios. Clear definitions reduce uncertainty and allow manufacturers to scale formulations without repeated regulatory reassessment.

Consumer expectations also shape usage. Shoppers demand consistent taste and shelf life while showing sensitivity to ingredient simplicity. Acidity regulators help reconcile these pressures by improving the performance of natural flavours and plant-based ingredients, and in some cases enabling lower preservative intensity through better pH control.

Innovation in functional and low-sugar beverages is another catalyst. As sugar reduction alters mouthfeel and flavour release, precise acid balance becomes critical to maintaining sensory appeal and aftertaste quality.

Segmentation Highlights by Type and Application

Acetic acid holds the largest share of UK demand, accounting for 25.6% of usage. Its sharp, clean flavour profile, predictable processing behaviour, and broad availability make it a preferred choice across sauces, savoury foods, pickled products, and selected beverages. Procurement teams also value its supply resilience and mature logistics network.

Beverages represent the largest application segment with a 34.5% share. Drinks are highly sensitive to pH drift, which can alter sweetness perception, aroma release, colour stability, and carbonation performance. Tight acid management ensures that a brand’s sensory signature remains consistent from first batch to last.

Other categories reinforce steady demand. Sauces and dressings depend on acidity regulators to stabilise emulsions and control microbial risk. Processed foods use them to protect texture during heating and storage. Bakery applications integrate acids into leavening systems, while confectionery relies on them for flavour clarity and texture control in sour and gummy products.

Market Dynamics, Risks, and Opportunities

Growth is supported by packaged food expansion, beverage innovation, and stronger in-house quality systems where acidity targets act as HACCP control points. However, raw material price volatility and label simplification trends can influence formulation choices. Suppliers that help customers optimise dosing and avoid over-acidification gain a competitive edge.

Regionally, England leads growth with a 9.8% CAGR, driven by dense manufacturing clusters and high SKU diversity. Scotland follows with quality-driven procurement in beverages and premium foods. Wales benefits from reformulation activity in packaged foods, while Northern Ireland shows steady gains supported by long-running, high-volume SKUs.

To explore detailed market data, segment-wise forecasts, and competitive insights, request a sample report. https://www.futuremarketinsights.com/reports/sample/rep-gb-31624

Competitive Landscape

Competition centres on purity assurance, batch consistency, documentation quality, and technical service depth. Key participants include Archer Daniels Midland Company, Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, and Corbion N.V., each competing through supply reliability, formulation expertise, and compliance support.

Browse Related Insights

Acidity Regulator Market: https://www.futuremarketinsights.com/reports/acidity-regulator-market

Demand for Acidity Regulators in UK: https://www.futuremarketinsights.com/reports/united-kingdom-acidity-regulators-market

Demand for Acidity Regulator in South Korea: https://www.futuremarketinsights.com/reports/south-korea-acidity-regulator-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1,200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.