Isosorbide-Based Engineering Polymer Monomers Market to Reach USD 1.32 Billion by 2036 on Rising Bio-Based Demand

Isosorbide-based engineering polymer monomers market to grow at 8.5% CAGR through 2036, driven by bio-derived performance substitution in polymers.

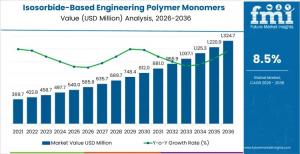

NEWARK, DE, UNITED STATES, January 16, 2026 /EINPresswire.com/ -- The global isosorbide-based engineering polymer monomers market is projected to expand from USD 585.9 million in 2026 to USD 1,324.7 million by 2036, registering a compound annual growth rate (CAGR) of 8.5%. Growth is being driven by rising demand for bio-derived monomers that deliver mechanical strength, thermal stability, and dimensional control comparable to petroleum-based alternatives, particularly in high-performance engineering polymers.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-31444

Market Overview: Who Is Driving Growth and Why It Matters Now

Isosorbide-based engineering polymer monomers are bio-based intermediates derived from glucose and used in polycarbonates, polyesters, and specialty resins. These monomers are increasingly adopted across automotive components, electronics housings, optical parts, and consumer goods, where performance requirements remain non-negotiable. Polymer producers and compounders are integrating isosorbide to meet regulatory, customer, and materials compliance expectations without compromising strength or heat resistance.

Competitive power in this market is concentrated among a limited group of producers with proprietary bio-feedstock access, high-purity processing capabilities, and deep integration into polymer value chains. Pricing stability is reinforced through long-term supply agreements, co-development partnerships, and lengthy qualification cycles that create switching costs once monomers are embedded into validated polymer formulations.

Market Size, Forecast, and Key Metrics

• Market value (2026): USD 585.9 million

• Forecast value (2036): USD 1,324.7 million

• Forecast CAGR (2026–2036): 8.5%

• Leading derivative type: Isosorbide-based diols (38% share)

• Key regions: Asia Pacific, Europe, North America, Latin America, Middle East & Africa

Volume growth is increasingly captured by integrated chemical groups and upstream bio-feedstock specialists that can balance cost efficiency, purity, and supply reliability at scale.

Performance Substitution and Compliance Fuel Adoption

Adoption is accelerating as polymer manufacturers seek bio-derived monomers that offer performance parity with conventional petrochemical inputs. Isosorbide contributes rigidity, optical clarity, and thermal resistance when incorporated into polycarbonates, polyesters, and specialty copolymers. These attributes are particularly valued in applications requiring high stiffness, heat deflection, and dimensional stability.

Qualification economics play a central role. Polymer producers prioritize monomers that integrate into existing polymerization processes with minimal catalyst, equipment, or cycle-time adjustments. Suppliers offering application-ready grades, technical data packages, and co-development support are reducing validation risk and shortening time-to-market for downstream users.

Segment Analysis: Where Demand Is Concentrated

By derivative type, isosorbide-based diols dominate the market with a 38% share, reflecting their widespread use as building blocks in high-performance polymer systems. Their rigid bicyclic structure improves glass transition temperature and dimensional stability while maintaining predictable reactivity and process compatibility.

By application, engineering plastics and compounds account for 32% of total demand. These materials are widely used in automotive interiors, electronics, and industrial components where long-term durability and thermal performance are critical. Compounders favor isosorbide-based monomers that enhance mechanical properties without sacrificing injection molding or extrusion efficiency.

Technology, Cost, and Integration Dynamics

Advances in catalytic processing, fermentation efficiency, and purification technologies are improving yields and cost trajectories for high-purity isosorbide. At the same time, economic competitiveness remains a restraint. Bio-derived feedstocks and specialized production infrastructure can increase costs relative to petrochemical routes, particularly for large-volume applications.

Technical integration challenges also persist. Incorporating new monomers into established polymer systems may require reformulation and extended validation to ensure performance equivalence. These factors can slow adoption but also reinforce supplier stickiness once qualification is complete.

Regional Growth Patterns Highlight Emerging and Mature Opportunities

Growth varies significantly by country based on engineering plastics production, downstream manufacturing intensity, and material substitution trends.

• China leads with a 9.7% CAGR, driven by automotive, electronics, and industrial manufacturing expansion.

• Brazil follows at 9.3% CAGR, supported by rising demand for higher-performance plastics in automotive and consumer goods.

• Germany grows at 8.1% CAGR, reflecting premium adoption in advanced engineering and automotive applications.

• South Korea (7.7%) and Japan (7.0%) emphasize precision, reliability, and long qualification cycles in electronics and mobility sectors.

Buy Report Now – Click Here to Purchase the Report: https://www.futuremarketinsights.com/checkout/31444

Competitive Landscape: Integration Over Claims

Competition centers on monomer purity, processing compatibility, and integration into existing polymer platforms rather than sustainability positioning alone. Roquette Frères anchors the market with large-scale bio-derived isosorbide production. Global chemical majors including Mitsubishi Chemical Group, Mitsui Chemicals, Covestro, and BASF SE embed isosorbide into established engineering plastics portfolios. Asian and downstream-integrated players such as Toray Industries, Teijin, Indorama Ventures, Eastman Chemical Company, and RadiciGroup compete through application-specific formulation depth and scalable supply strategies.

Key Players in Isosorbide-Based Engineering Polymer Monomers Market

• Roquette Frères

• Mitsubishi Chemical Group

• Mitsui Chemicals

• Covestro

• BASF SE

• Toray Industries

• Teijin

• Indorama Ventures

• Eastman Chemical Company

• RadiciGroup

Browse Related Insights

Polymeric Sand Market: https://www.futuremarketinsights.com/reports/polymeric-sand-market

Polymer Solutions for High Voltage Battery Separator Chemistries Market: https://www.futuremarketinsights.com/reports/polymer-solutions-for-high-voltage-battery-separator-chemistries-market

Polymer Bearings Market: https://www.futuremarketinsights.com/reports/polymer-bearings-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization trusted by Fortune 500 companies and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI delivers data-backed insights and strategic intelligence across 30+ industries and 1,200+ markets worldwide, enabling clients to navigate complex market transitions with confidence.

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.